2018/19 Federal Budget

- Personal income tax changes

1.1 Personal income tax plan

The Government will introduce a seven-year, three-step, Personal Income Tax Plan, as follows:

Step 1: Targeted tax relief to low and middle income earners

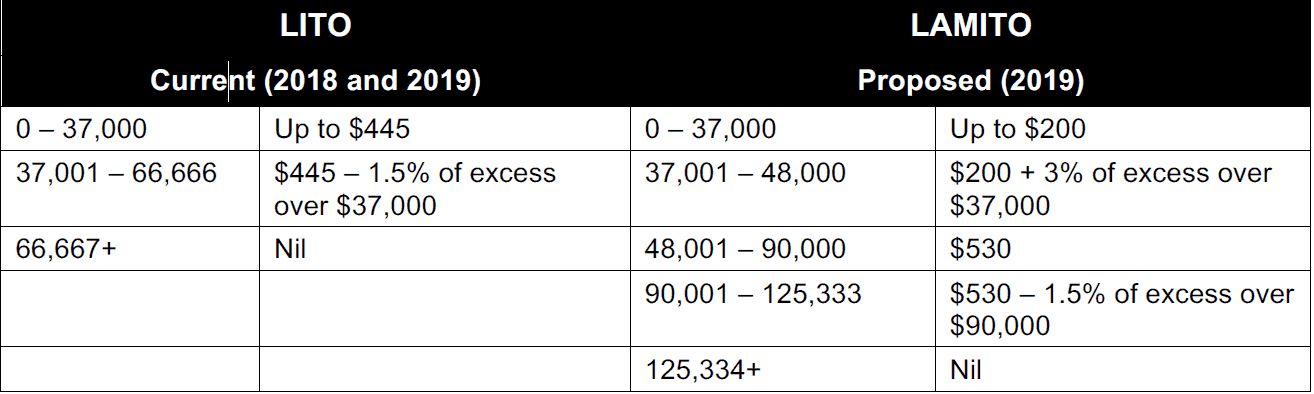

The Government will introduce the Low and Middle Income Tax Offset, a non-refundable tax offset of

up to $530 per annum to Australian resident low and middle income taxpayers. The offset will be

available for the 2019, 2020, 2021 and 2022 income years and will be received as a lump sum on

assessment after an individual lodges their tax return.

The benefit of the proposed Low and Middle Income Tax Offset is as follows:

- Taxpayers with taxable incomes of $37,000 or less will receive a benefit of up to $200;

- For taxpayers with taxable incomes between $37,000 and $48,000, the value of the offset will

increase at a rate of three cents per dollar to the maximum benefit of $530;

- For taxpayers with taxable incomes from $48,000 to $90,000 a $530 offset applies; and

- For taxpayers with taxable incomes from $90,001 to $125,333, the offset will phase out at a rate of

1.5 cents per dollar.

The benefit of the Low and Middle Income Tax Offset is in addition to the Low Income Tax Offset.

Step 2: Protecting middle income Australians from bracket creep

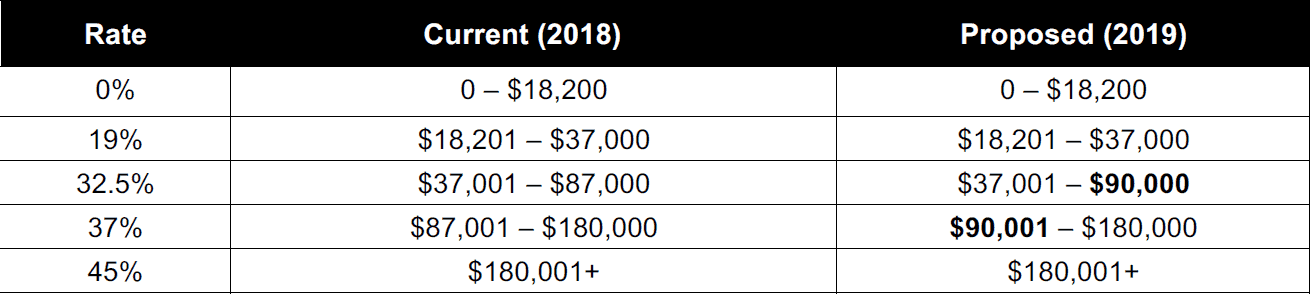

The Government has proposed the following changes to the personal income tax rates:

- From 1 July 2018, the Government will increase the top threshold of the 32.5% personal income

tax bracket from $87,000 to $90,000. The rates below do not include the Medicare Levy.

section 2

- From 1 July 2022, the Government will:

- extend the 19% personal income tax bracket from $37,000 to $41,000; and

- further increase the top threshold of the 32.5% personal income tax bracket from $90,000 to $120,000.

The Government has also proposed an increase to the Low Income Tax Offset from $445 to $645

from 1 July 2022. This offset will reduce at a rate of 6.5 cents per dollar between incomes of

$37,000 and $41,000, and at a rate of 1.5 cents per dollar between $41,000 and $66,667.

Step 3: Ensuring Australians pay less tax by making the system simpler

In the third step of the Personal Income Tax Plan the Government will simplify and flatten the personal

tax system by removing the 37% tax bracket entirely. From 1 July 2024, the Government will extend

the top threshold of the 32.5% personal income tax bracket from $120,000 to $200,000. The 32.5% tax

bracket will apply to taxable incomes of $41,001 to $200,000 and taxpayers with taxable incomes

exceeding $200,000 will pay tax at the top marginal rate of 45%.

1.2 Changes to the Medicare levy low-income thresholds

The Government will increase the Medicare levy low-income thresholds for singles, families, and

seniors and pensioners from the 2018 income year, as follows:

- The threshold for singles will be increased from $21,655 to $21,980;

- The family threshold for will be increased from $36,541 to $37,089;

- The threshold for single seniors and pensioners will be increased from $34,244 to $34,758; and

- The family threshold for seniors and pensioners will be increased from $47,670 to $48,385.

For each dependent child or student, the family income thresholds increase by a further $3,406, instead

of the previous amount of $3,356.

2. Changes affecting business taxpayers

2.1 Extending the $20,000 immediate write-off for small business

The Government will extend the $20,000 immediate write-off for small business by a further 12-months

to 30 June 2019 for businesses with aggregated annual turnover less than $10 million.

Small businesses will be able to immediately deduct purchases of eligible assets costing less than

$20,000 first used or installed ready for use by 30 June 2019. Only a few assets are not eligible (such

as horticultural plants and in-house software).

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed

into the small business simplified depreciation pool (the pool) and depreciated at 15% in the first

income year and 30% each income year thereafter. The pool can also be immediately deducted if the

balance is less than $20,000 over this period (including existing pools).

Further to this, the current ‘lock out’ laws for the simplified depreciation rules (preventing small

businesses from re-entering the simplified depreciation regime for five years if they opt out) will

continue to be suspended until 30 June 2019.

2.2 Removing tax deductibility of payments where withholding

obligations have been disregarded

From 1 July 2019, businesses will no longer be able to claim a deduction for the following payments:

• Payments to their employees such as wages where they have not withheld any amount of PAYG

from these payments (i.e., despite the fact the PAYG withholding requirements apply).

• Payments made by businesses to contractors where the contractor does not provide an ABN and

the business does not withhold any amount of PAYG (despite the withholding requirements

applying).

2.3 Introduction of an economy-wide cash payment limit

From 1 July 2019, the Government will introduce a limit of $10,000 for cash payments made to

businesses for goods and services. Currently, large undocumented cash payments can be used to

avoid tax or to launder money from criminal activity. This measure will require transactions over a

threshold to be made through an electronic payment system or cheque. Transactions with financial

institutions or consumer to consumer non-business transactions will not be affected.

2.4 Expanding the contractor payment reporting system

The contractor payment reporting system was first introduced in the building and construction industry

and extended to the cleaning and courier industries from 1 July 2018. Under the contractor payment

reporting system, businesses are required to report payments to contractors to the ATO. This brings

payments to contractors in these industries into line with wages, which are reported to the ATO.

The Government has announced it will further expand the contractor payment reporting system to the

following industries:

• security providers and investigation services;

• road freight transport; and

• computer system design and related services.

Businesses will need to ensure that they collect information from 1 July 2019, with the first annual

report required in August 2020. A new online form will make the reporting process easier.

2.5 Alienating rights to partnership income (Everett assignments)

From 7:30PM (AEST) on 8 May 2018, partners that alienate their income by creating, assigning or

otherwise dealing in rights to the future income of a partnership will no longer be able to access the

small business capital gains tax (CGT) concessions in relation to these rights.

The small business CGT concessions assist owners of small businesses by providing relief from CGT

on the disposal of assets related to their business. However, some taxpayers, including large

partnerships, are able to inappropriately access these concessions in relation to their assignment of a

right to the future income of a partnership to an entity, without giving that entity any role in the

partnership.

3. Superannuation related changes

3.1 Exemption from the work test for voluntary contributions

From 1 July 2019, the Government will introduce an exemption from the work test for voluntary

contributions to superannuation, for people aged 65-74 with superannuation balances below $300,000,

in the first year that they do not meet the work test requirements. Under current law, the work test

restricts the ability to make voluntary superannuation contributions for those aged 65-74 to individuals

who self-report as working a minimum of 40 hours in any 30 day period in the financial year.

The work test exemption will give recent retirees additional flexibility to get their financial affairs in order

in the transition to retirement.

3.2 Three-yearly audit cycle for some SMSFs

From 1 July 2019, the Government will change the annual audit requirement to a three-yearly

requirement for SMSFs with a history of good record-keeping and compliance. This measure will

reduce red tape for SMSF trustees that have a history of three consecutive years of clear audit reports

and that have lodged the fund’s annual returns in a timely manner.

3.3 Increasing the maximum number of allowable members in an

SMSF and small APRA fund

From 1 July 2019, the Government will increase the maximum number of allowable members in new

and existing SMSFS and small APRA funds from four to six. This will provide greater flexibility for joint

management of retirement savings, in particular for large families.

3.4 Preventing inadvertent concessional cap breaches by certain

Employees

From 1 July 2018, the Government will allow individuals whose income exceeds $263,157, and who

have multiple employers, to nominate that their wages from certain employers are not subject to the

superannuation guarantee (SG). The measure will allow eligible individuals to avoid unintentionally

breaching the $25,000 annual concessional contributions cap as a result of multiple compulsory

SG contributions. Employees who use this measure could negotiate to receive additional income,

which is taxed at marginal tax rates.

3.5 Deductions for personal contributions

The Government intends to improve the integrity of the ‘notice of intent’ (‘NOI’) processes for claiming

personal superannuation contribution tax deductions. Currently, some individuals receive deductions

on their personal superannuation contributions but do not submit a NOI, despite being required to do

so. This results in their superannuation funds not applying the appropriate 15% tax to their contribution.

As the contribution has been deducted from the individual’s income, no tax is paid on it at all.

The additional funding will enable the ATO to develop a new compliance model, and to undertake

additional compliance and debt collection activities. From 1 July 2018, the ATO will modify income tax

returns to alert individuals to the NOI requirements with a tick box to confirm they have complied.

3.6 Minor technical amendments

The Government will make a series of minor amendments to Treasury portfolio legislation to clarify the

law, correct technical or drafting defects, remove anomalies and address unintended outcomes.

The amendments include two changes that will be beneficial for superannuation funds and their

members. These are technical amendments to the transition to retirement income stream rules relating

to the death of a member and addressing double taxation in respect of deferred annuities purchased by

a superannuation fund or retirement savings account.

Further information can be found in the Explanatory Memorandum to the Treasury Laws Amendment

(2018 Measures No. 4) Bill 2018.

3.7 Capping passive fees, banning exit fees and reuniting small and

inactive superannuation accounts

From 1 July 2019, the Government will introduce a 3% annual cap on passive fees charged by

superannuation funds on accounts with balances below $6,000 and will ban exit fees on all

superannuation accounts. The Government will also strengthen the ATO-led consolidation regime by

requiring the transfer of all inactive superannuation accounts where the balances are below $6,000 to

the ATO. The ATO will expand its data matching processes to proactively reunite these inactive

superannuation accounts with the member’s active account, where possible.

3.8 Changes to insurance in superannuation

The Government will change the insurance arrangements for certain superannuation members.

Insurance within superannuation will move from a default framework to an opt-in basis for: members

with low balances of less than $6,000; members under the age of 25 years; and members whose

accounts have not received a contribution in 13 months and are inactive.

The changes will take effect on 1 July 2019 — affected superannuants will have a period of 14 months

to decide whether they will opt-in to their existing cover or allow it to switch off.

4. Changes affecting companies

4.1 Division 7A changes

From 1 July 2019, the Government will ensure that unpaid present entitlements (‘UPEs’) come within

the scope of Division 7A of the ITAA 1936. This will apply where a related private company is made

entitled to a share of trust income as a beneficiary but has not been paid. This measure will ensure the

UPE is either required to be repaid to the private company over time as a complying loan under S.109N

of the ITAA 1936 or is subject to tax as a dividend.

The Government also announced that it will defer the start date of the Ten Year Enterprise Tax Plan —

targeted amendments to Division 7A measure that was announced in the 2016-17 Budget from

1 July 2018 to 1 July 2019. Under this plan, the Government intends to make targeted amendments to

improve the operation and administration of Division 7A of the ITAA 1936, including:

• a self-correction mechanism for inadvertent breaches of Division 7A;

• appropriate safe-harbour rules to provide certainty;

• simplified Division 7A loan arrangements; and

• a number of technical adjustments to improve the operation of Division 7A and provide increased

certainty for taxpayers.

4.2 Reforms to combat illegal phoenixing

The Government will reform the corporations and tax laws and provide the regulators with additional

tools to assist them to deter and disrupt illegal phoenix activity. The package includes reforms to:

• extend the Director Penalty Regime to GST, luxury car tax and wine equalisation tax, making

directors personally liable for the company’s debts;

• expand the ATO’s power to retain refunds where there are outstanding tax lodgements;

• introduce new phoenix offences to target those who conduct or facilitate illegal phoenixing;

• prevent directors improperly backdating resignations to avoid liability or prosecution;

• limit the ability of directors to resign when this would leave the company with no directors; and

• restrict the ability of related creditors to vote on the appointment, removal or replacement of an

external administrator.

4.3 Research and development tax incentive

The Government will amend the research and development (R&D) tax incentive to better target the

program and improve its integrity and fiscal affordability with effect from 1 July 2018.

For companies with aggregated annual turnover of $20 million or more, the Government will introduce

an R&D premium that ties the rates of the non-refundable R&D tax offset to the incremental intensity of

R&D expenditure as a proportion of total expenditure for the year. The marginal R&D premium will be

the claimant’s company tax rate plus:

• 4 percentage points for R&D expenditure between 0% to 2% R&D intensity;

• 6.5 percentage points for R&D expenditure above 2% to 5% R&D intensity;

• 9 percentage points for R&D expenditure above 5% to 10% R&D intensity; and

• 12.5 percentage points for R&D expenditure above 10% R&D intensity.

The R&D expenditure threshold — the maximum amount of R&D expenditure eligible for concessional

R&D tax offsets, will be increased from $100 million to $150 million per annum.

For companies with aggregated annual turnover below $20 million, the refundable R&D offset will be a

premium of 13.5 percentage points above a claimant’s company tax rate. Cash refunds from the

refundable R&D tax offset will be capped at $4 million per annum. R&D tax offsets that cannot be

refunded will be carried forward as non-refundable tax offsets to future income years.

Refundable R&D tax offsets from R&D expenditure on clinical trials will not count towards the cap.

5. Changes affecting trusts

5.1 Improving the taxation of testamentary trusts

From 1 July 2019, the concessional tax rates available for minors receiving income from testamentary

trusts will be limited to income derived from assets that are transferred from the deceased estate or the

proceeds of the disposal or investment of those assets.

Currently, income received by minors from testamentary trusts is taxed at normal adult rates rather than

the higher tax rates that generally apply to minors. However, some taxpayers are able to

inappropriately obtain the benefit of this lower tax rate by injecting assets unrelated to the deceased

estate into the testamentary trust. This measure will clarify that minors will be taxed at adult marginal

tax rates only in respect of income a testamentary trust generates from assets of the deceased estate

(or the proceeds of the disposal or investment of these assets).

5.2 Extending anti-avoidance rules for circular trust distributions

From 1 July 2019, the Government will extend a specific anti-avoidance rule to family trusts that applies

to other closely held trusts that engage in circular trust distributions.

Currently, where family trusts act as beneficiaries of each other in a ‘round robin’ arrangement, a

distribution can be ultimately returned to the original trustee — in a way that avoids any tax being paid

on that amount. This measure will better enable the ATO to pursue family trusts that engage in these

arrangements by extending the specific anti-avoidance rule, imposing tax on such distributions at a rate

equal to the top personal tax rate plus the Medicare levy.

6. Other income tax changes

6.1 Deductions denied for vacant land

From 1 July 2019, the Government will deny deductions for expenses associated with holding vacant

residential or commercial land, including interest incurred to finance the acquisition of the land.

Deductions for expenses associated with holding the land will be available once a property has been

constructed on the land, it has received approval to be occupied and is available for rent.

Denied deductions will not be able to be carried forward for use in later income years, however, denied

deductions can be included in the cost base of the land (but only if the expense qualifies as an element

of cost base under the usual rules).

This proposed measure is intended to apply to all entities (e.g., individuals, trusts, companies) however

an exclusion applies for vacant land that is held by an entity that is carrying on a business, which would

include a business of primary production.

6.2 Taxation of income for an individual’s fame or image

From 1 July 2019, high profile individuals are no longer able to take advantage of lower tax rates by

licencing their fame or image to another entity.

High profile individuals (such as sportspeople and actors) can currently licence their fame or image to

another entity such as a related company or trust. Income for the use of their fame or image goes to

the entity that holds the licence. This creates opportunities to take advantage of different tax treatments

and facilitates misreporting and incorrect tax outcomes.

This measure will ensure that all remuneration (including payments and non-cash benefits) provided for

the commercial exploitation of a person’s fame or image will be included in the assessable income of

that individual.

7. GST changes

7.1 Extended GST for offshore sellers of hotel accommodation

From 1 July 2019, the Government will extend the GST by ensuring that offshore sellers of hotel

accommodation in Australia calculate their GST turnover in the same way as local sellers.

Currently, unlike GST-registered businesses in Australia, offshore sellers of Australian hotel

accommodation are exempt from including sales of hotel accommodation in their GST turnover. This

means they are often not required to register for and charge GST on their mark-up over the wholesale

price of the accommodation. The exemption was introduced in 2005, when most offshore sales of

Australian hotel rooms were to foreigners booking through offshore tour operators, and the online

booking market was small.

Both Australian and foreign consumers are increasingly booking Australian hotel rooms through online

services based offshore, which are taking advantage of the exemption designed for offshore tour

operators. Removing the exemption will level the playing field by ensuring the same tax treatment of

Australian hotel accommodation, whether booked through a domestic or offshore company.

This measure follows the Government’s decision to extend the GST to digital products and other

services from 1 July 2017 and to low value imported goods from 1 July 2018.

8. Other budget announcements

8.1 Removing the CGT discount at trust level for Managed Investment

Trusts

From 1 July 2019, the Government will prevent Managed Investment Trusts (‘MITs’) and Attribution

MITs (‘AMITs’) from applying the 50% capital gains discount at the trust level. Under the measure,

MITs and AMITs that derive a capital gain will still be able to distribute this income as a capital gain that

can be discounted in the hands of the beneficiary (provided the beneficiary is eligible).

8.2 Compliance activities targeting individuals and their tax agents

The Government will provide $130.8 million to the ATO from 1 July 2018 to increase compliance

activities targeting individual taxpayers and their tax agents. The ATO has identified a number of

significant compliance issues for individual taxpayers. This measure will continue four income matching

programs that would otherwise terminate from 1 July 2018 to allow the ATO to detect incorrect reporting

of income, such as foreign source income of high wealth individuals. The measure will also provide

funding for new compliance activities, including additional audits and prosecutions, improving education

and guidance materials and pre-filling of income tax returns.

8.3 Income tax exemption for certain Veteran Payments

From 1 May 2018, the Government exempted certain Veteran Payments from income tax. From this

date, supplementary amounts (such as the pension supplement, rent assistance and remote area

allowance) of Veteran Payments paid to a veteran, and full payments (including the supplementary

component) made to the spouse or partner of a veteran who dies, are exempt from income tax.

8.4 Tightening concessions for foreign investors

The Government will introduce a package of measures to address risks to the corporate tax base posed

by stapled structures and similar arrangements. The package will also limit access to concessions for

passive income utilised by foreign governments and foreign pension funds. Some key elements of the

package include the following changes, which take effect from 1 July 2019 subject to transitional rules:

• applying a final withholding tax set at the corporate tax rate (currently 30%) to distributions derived

from trading income that has been converted to passive income using a MIT, excluding rent received

from third parties. A 15 year exemption is available from this element of the package for new,

Government-approved nationally significant infrastructure staples;

• limiting the foreign pension fund withholding tax exemption for interest and dividends to portfolio

investments only. As a result interest and dividend income derived by foreign pension funds from

non-portfolio investments will be subject to withholding tax;

• creating a legislative framework for the existing tax exemption for foreign governments (including

sovereign wealth funds), and limiting the exemption to portfolio investments. As a result, income

derived by foreign government investors from non-portfolio investments will be taxed; and

• investments in agricultural land will not be able to access the 15% concessional MIT withholding tax

rate.

No comments yet.